|

|

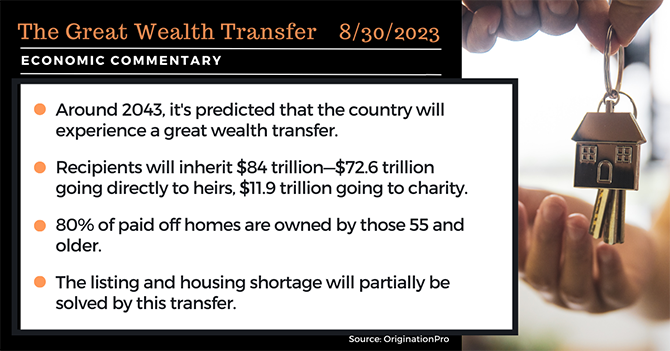

According to TheStreet.com, the Baby Boomer generation owns about half of the nation’s $140 trillion in wealth. Around the year 2043, a lot of that wealth, property and assets will be transferred to millennials—a change that will affect the real estate market significantly.

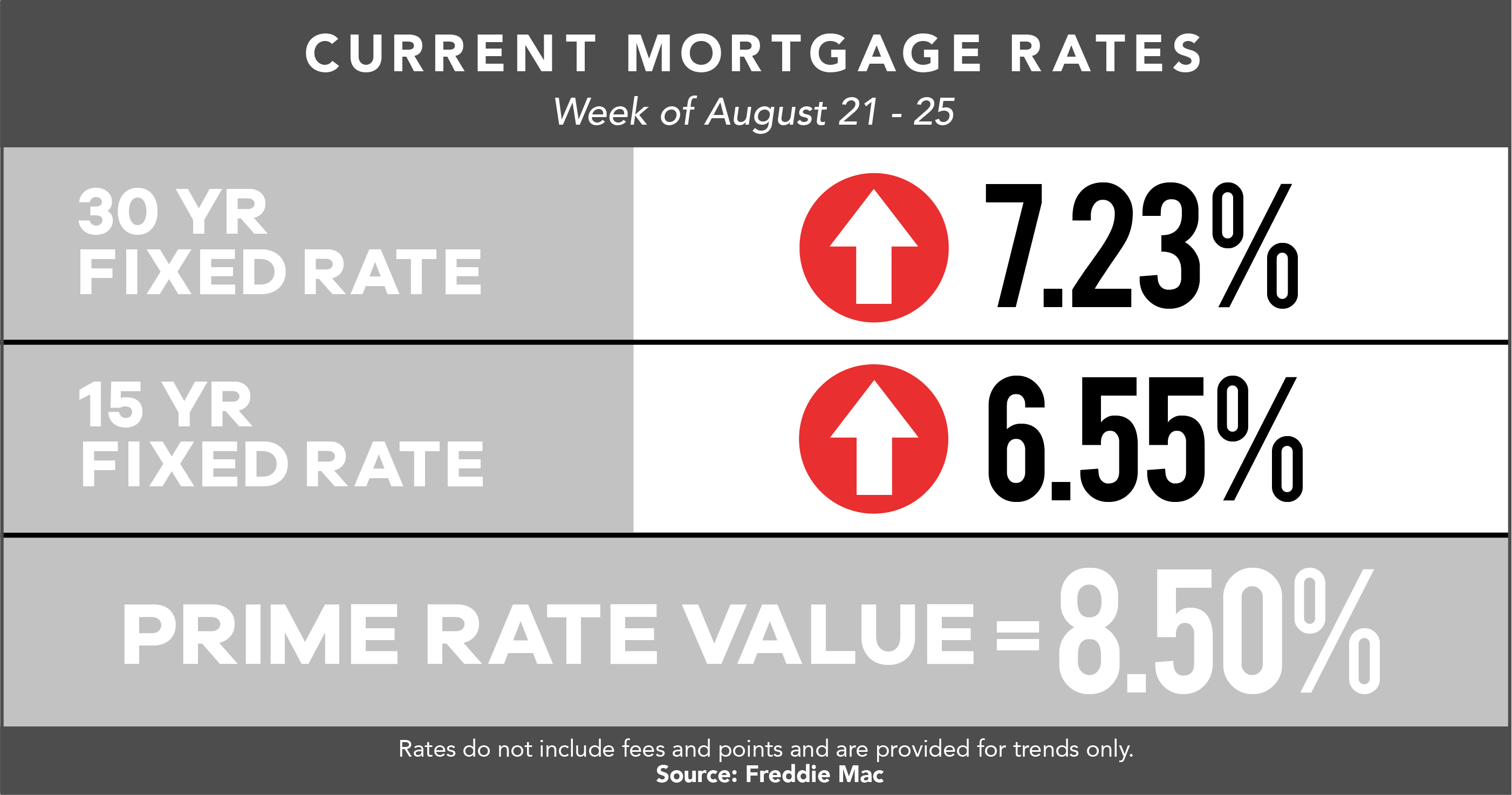

Rates continued to rise last week, though they eased a bit as the survey period ended-- hopefully the start of a new trend.

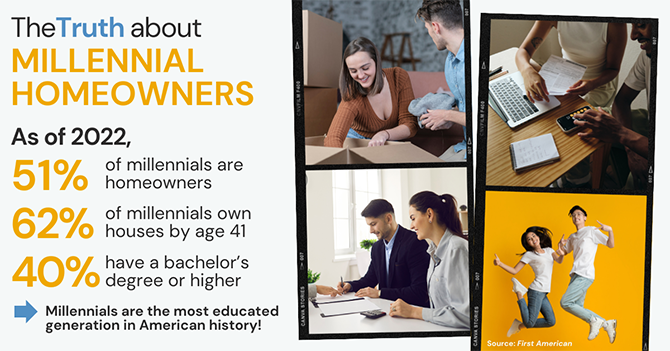

Millennials are the largest generation in U.S. history. A common misnomer regarding the millennial generation once was that they were destined to be a generation of renters--avocado toast, anyone? Recent data proves otherwise…

Other News

ATTOM reported nearly half–49%–of mortgaged residential properties in the United States were considered equity-rich in the second quarter, up from 47% in early 2023. “Equity-rich” means the estimated amount of loan balances secured by those properties was no more than half of their estimated market values. The firm’s second-quarter U.S. Home Equity & Underwater Report said the equity-rich figure stands at its highest point in at least four years. “With home prices rebounding across the U.S., the level of equity-rich mortgage-payers went up from the first quarter of 2023 to the second quarter of 2023 in 45 of the nation’s 50 states,” the report said. The gains followed two straight quarterly drop-offs caused by a temporary slowdown in the U.S. housing market that had threatened to end a decade-long run of price and equity growth, ATTOM said. The second-quarter upturn marked another sign of how the market shift has helped homeowners, as home-seller profits also spiked. “The second-quarter market revival bestowed immediate benefits on homeowners around the nation in the form of better profits for sellers and rising equity for those staying put,” said ATTOM CEO Rob Barber. “Equity levels were high even during the recent downturn, and now they are going back up and better than ever.” Barber noted the market remains in flux and the recent improvement could easily be temporary. “Lots of changing forces are at work affecting whether boom times are really back, especially amid a recent increase in mortgage rates,” he said. “But with the 2023 peak buying season still underway, it seems that homeowners can reasonably expect their household balance sheets to grow a bit more in the near future.” The report also found that less than 3 percent of mortgaged homes in the U.S., or one in 36, were considered seriously underwater in the second quarter, meaning they had a combined estimated balance of loans secured by the property of at least 25 percent more than the property’s estimated market value. Source: Mortgage Bankers Association

Many Americans have made significant inroads in paying off personal debt in the last four years, but at $21,800 not including mortgages, the average debt level is getting in the way of other opportunities such as investing, a survey by Northwestern Mutual found. While the overall average is $8,000 less than it was in 2019 and down $554 from last year, 35% of Americans said they’re either carrying or close to carrying the highest level of debt they’ve ever had, the survey said. At the same time, 43% said their debt is now close to or at the lowest level it’s ever been. At a time of high inflation and economic uncertainty, it's encouraging to see personal debt levels have held relatively steady year-over-year, and even ticked down a little," wrote Christian Mitchell, chief customer officer at Northwestern Mutual, in the 2023 Planning & Progress Study. "That said, it can be a slippery slope between manageable debt and runaway debt, so it's an important time to remain extra vigilant about planning and spending." Milwaukee-based Northwestern Mutual’s survey included 2,740 online interviews of U.S. adults earlier in 2023. Not surprisingly, the survey found the primary source of personal debt was credit cards, accounting for 28% of it. Car loans, at 12%, were the next most common source, followed by medical debt at 7%, home equity loans at 6%, personal education loans at 5% and educational expenses for children or family members at 3%. And the toll of this debt in 2023 is high. Americans with personal debt on average indicated that 30% of their monthly income goes to paying it off, and 61% of debtors said paying it off is a higher priority than any savings. Thirty-nine percent said they’re putting savings first. Source: Financial Advisor |

|

Sent By Primary Residential Mortgage, Inc, 795 Shadowleaf Ave, Twin Falls ID 83301 If you do not want to receive future e-mails from me, click unsubscribe. Thank You.

Sent By Primary Residential Mortgage, Inc, 795 Shadowleaf Ave, Twin Falls ID 83301 If you do not want to receive future e-mails from me, click unsubscribe. Thank You.