|

|

The potential rollback of the CFPB and re-privatization of mortgage agencies raises concerns about financial stability and housing affordability.

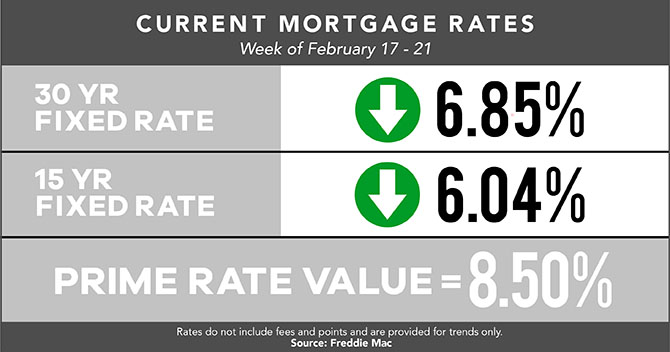

The Freddie Mac rate survey indicated that mortgage rates were slightly lower again in the past week.

A recent survey by Clever Real Estate reveals that while homeowners prefer remodeling to moving, most face budget overruns, delays, and stress during renovations, but still acknowledging positive outcomes.

Other News

Home prices finished 2024 strong, NAR data shows, and in the last five years alone, median home prices have jumped 50%. Property owners are getting richer as home prices prove resilient against lower home sales. Nearly 90% of metro areas registered home price increases in the final quarter of 2024, according to the latest housing data from the National Association of REALTORS®. Fourteen percent of the 226 metros NAR tracks posted double--digit price gains, up from 7% in the third quarter. "Record--high home prices and the accompanying housing wealth gains are definitely good news for property owners," says NAR Chief Economist Lawrence Yun. "However, renters who are looking to transition into homeownership face significant hurdles." The high home prices are making it difficult for real estate newcomers to save up for a down payment. Still, FOMO may be setting in for those would--be homeowners as wealth accumulation for homeowners far outpaces that of renters. The spread in median net worth between homeowners and renters stands at $415,000 for homeowners versus $10,000 for renters, NAR has previously reported. The national median price for a single--family existing home rose nearly 5% in the fourth quarter of last year compared to a year earlier, settling in at $410,100, NAR's fourth--quarter data shows. In the last five years alone, median home prices have jumped 50%. Despite the widespread home price gains, housing affordability "marginally improved" in the fourth quarter, according to NAR. The monthly mortgage payment on a typical existing single--family home was $2,134 (assuming a 20% down payment). That is down by 1.7%, or $37 compared to a year ago, NAR reports. Source: NAR

More homeowners appear willing to sell their homes, a recent Zillow survey of homeowners suggests. Nearly one in five respondents indicated their homes were already listed for sale or they would consider selling their home within the next three years, Zillow reported. Among respondents who indicated they might sell, some 15% said their home was already listed, while 48% indicated they would consider selling within the next year. A further 36% said they would consider doing so in the next two or three years. The overall number willing to sell ticked up from summer and fall surveys but remains below the percentages in most of the 2023 surveys, Zillow said. The share of homeowners with no intention of selling also shrunk from prior surveys, Zillow reported. Some 42% of respondents in the latest survey indicated they had no intention of selling. In 2021 and 2022, that share was above 50% in surveys, Zillow said. Respondents listed a desire for an upgraded home as the top reason for moving. Almost half said they plan to sell their home for a profit or use the equity for another purpose, Zillow said. Others cited a change in their household size as a factor.Zillow also asked people who have no intentions of selling why they want to stay in place. More than 70% said they love their current home. Concerns about the price of homes was another major reason cited by respondents. Zillow also asked about the impact of mortgage rates on decision--making. It found that homeowners with rates between 4%--4.99% were the most likely to sell. Some 11% of mortgaged homeowners have a rate above 6%, Zillow said. That percentage has doubled in two years. Source: Scotsman Guide |

|

Sent By The dela Cruz Team of KW Legacy, 1300 Bellona Ave, Suite D, Lutherville MD 21093

Sent By The dela Cruz Team of KW Legacy, 1300 Bellona Ave, Suite D, Lutherville MD 21093